Tax Deducted at Source (TDS) is a tax paid by an individual or a company to the Government of India. TDS is applicable to the income earned from various sources such as salary, winnings from lotteries, horse racing, etc. In India, TDS is applicable to the winnings from lotteries and horse races. This article will discuss the provisions of TDS on winning from lotteries and horse races.

TDS on Lottery Winnings

Lottery winnings are subject to TDS in India. As per the Income Tax Act, 1961, any winning from lotteries, crossword puzzles, races (including horse races), card games and other games of any sort or from gambling or betting of any form or nature whatsoever is taxable. According to Section 194B of the Income Tax Act, 1961, TDS is applicable at the rate of 30% on lottery winnings exceeding Rs. 10,000.

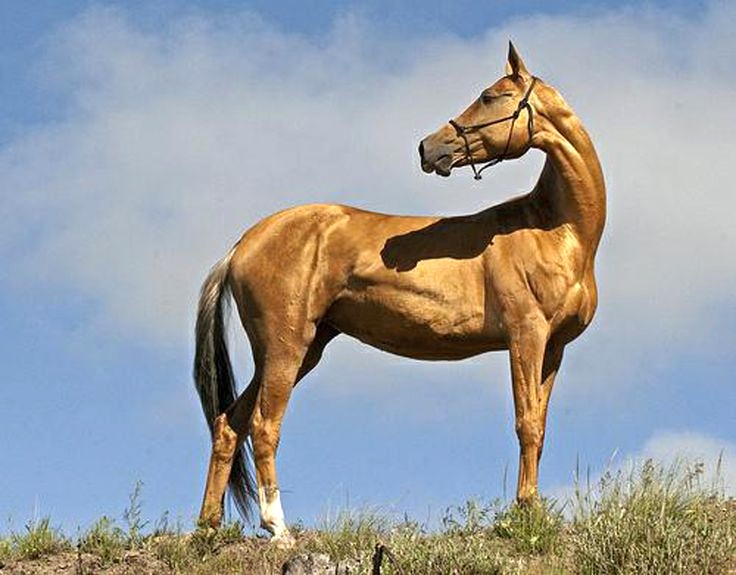

TDS on Horse Racing Winnings

Horse racing winnings are also subject to TDS in India. As per the provisions of the Income Tax Act, 1961, the winnings from horse races are taxable. According to Section 194BB of the Income Tax Act, 1961, TDS is applicable at the rate of 30% on winnings from horse racing exceeding Rs. 5,000.

Payment of TDS

The TDS on lottery winnings and horse racing winnings is to be paid by the payer to the Government of India. The payer is liable to deduct the tax at source and deposit the same to the Government of India. The payer is then required to issue a TDS certificate to the payee, which is a proof of the tax deducted and deposited. The payee can use the TDS certificate to claim a refund of the TDS deducted.

Conclusion

Tax Deducted at Source (TDS) is applicable to the winnings from lotteries and horse races. As per the Income Tax Act, 1961, TDS is applicable at the rate of 30% on lottery winnings exceeding Rs. 10,000 and horse racing winnings exceeding Rs. 5,000. The TDS is to be paid by the payer to the Government of India and the payer is liable to issue a TDS certificate to the payee. Thus, the provisions for TDS on winning from lotteries and horse races have been discussed in this article.